For businesses determined to understand their market and customers fully, metrics have always guided them toward success. From the early days of tracking website hits to the sophisticated data analytics of today, marketing analysts have always sought to find the metric that completely encapsulates the essence of business growth and customer satisfaction. Enter Customer Lifetime Value (CLV).

For online businesses and eCommerce ones in particular, CLV has emerged as a beacon shedding light on immediate sales or interactions and the long-term relationship between a brand and its customers.

But why has CLV gained such prominence recently, and why do I, Peter Murphy Lewis, as a fractional CMO, consider CLV the gold standard metric for businesses? In this article, I’ll delve deep into the world of CLV, exploring its nuances, significance, and unparalleled ability to reshape how businesses approach marketing and customer relations.

Whether you're a seasoned marketer or a business owner trying to understand the changing tides of the industry, I’ll provide you with information enabling you to better understand how you should move forward with adopting the CLV metric into your business. But first, what is a fractional CMO?

A fractional CMO, or fractional Chief Marketing Officer, is essentially an outsourced marketing executive. Unlike a traditional CMO who is employed full-time, I, as a fractional CMO, offer my expertise to companies without the long-term commitment of an employment contract. This means companies enjoy the benefits of:

- Expertise on demand

- Speed and efficiency of execution of marketing strategies

- Cost-effectiveness

With that out of the way, let’s dive into Customer Lifetime Value (CLV).

Understanding Customer Lifetime Value

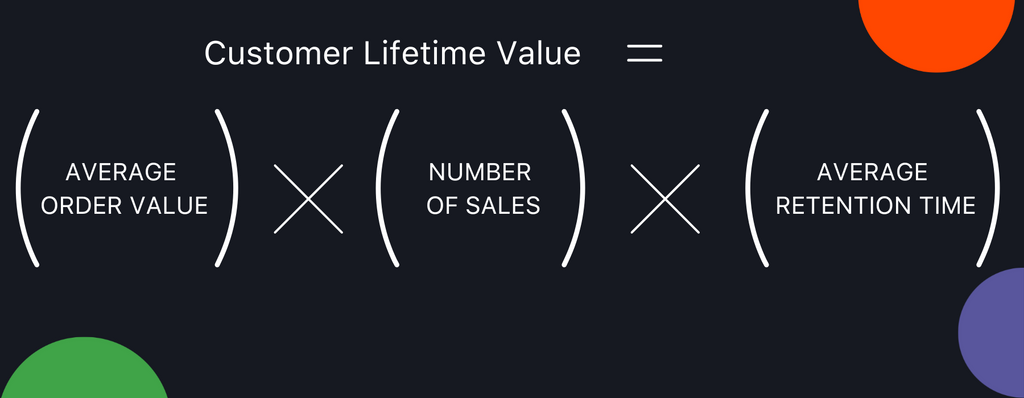

At its core, CLV represents the total net profit a company anticipates from a customer throughout the entirety of its relationship. It's not just about a one-time transaction or a customer's first purchase. Instead, CLV delves deeper, encapsulating the customer's entire journey with the brand.

Basically, if we were to break down the components of CLV, that would consist of:

- The initial purchase: This is the starting point of the customer's journey with a company. It's the first transaction that sets the tone for future interactions.

- Repeat purchases: A customer's value doesn't end with their first purchase. CLV takes into account the subsequent transactions, emphasising the importance of repeat business and the role of customer retention.

- The relationship duration: It's not just about how often a customer shops but also how long they stay loyal to the brand. The average duration of the customer's relationship with the company plays a pivotal role in determining the CLV. A long-term relationship often translates to consistent revenue over time.

So, how exactly do you calculate it?

But why is CLV a better metric when compared to other metrics? Let’s analyse some popular marketing metrics:

- Return on Investment (ROI): The classic metric that calculates the profitability of an investment. While ROI is a valuable financial metric, it often offers a limited view, focusing on immediate returns rather than long-term value.

- Cost per Acquisition (CPA): Widely used in digital marketing, CPA measures the cost to acquire one paying customer. While crucial for budgeting, it doesn't factor in that customer's long-term value or loyalty.

- Cost per Click (CPC): A staple in online advertising, CPC gauges the cost for each click on an ad. It measures immediate engagement but doesn't necessarily translate to long-term customer relationships or profitability.

It’s quite clear that traditional metrics, while valuable in their own right, often provide a myopic view of customer engagement. They tend to focus on immediate gains, whether a click, a sale, or a conversion.

This short-term perspective and short-term thinking can lead businesses to make decisions that boost immediate results but might not be beneficial in the long run. For instance, a campaign might have a low CPC but bring in customers who make one-time purchases and never return.

On the other hand, Customer Lifetime Value offers a more expansive view. Instead of just looking at the immediate value of a customer, CLV considers the entire potential revenue a customer can bring over the course of their relationship with a brand. It's not just about the first purchase; it's about every interaction, every referral, every repeat purchase.

In essence, CLV shifts the focus from transactional to relational, emphasising the importance of nurturing long-term customer relationships for sustained business growth.

Unlock the true potential of Customer Lifetime Value with Blend Commerce and transform your Shopify store into a long-term revenue machine!

11 Reasons Why CLV Is the New Gold Standard of Business Metrics

So, if I, as a fractional CMO, were to list reasons why CLV is the new gold standard for business metrics, the reasons would be:

- Sustainability indicator: One of the primary indicators of a brand's sustainability and profitability is the comparison between CLV and Customer Acquisition Cost (CAC). When you have a high CLV juxtaposed with a low CAC, it's a clear sign of a brand's potential scalability.

- Team efficiency: A soaring CLV is a testament to a team's efficiency. It indicates the team is on point, delivering the right message, product, and overall customer experience.

- Product validation: When your CLV is high, it's a clear sign of market validation. It means your product is being presented to the right audience at the opportune moment.

- Relevancy against competitors: In markets characterised by fleeting attention and fickle loyalties, a robust CLV suggests that your brand remains relevant and capable of weathering competition over extended periods.

- Investment guide: Businesses can make informed investment decisions by understanding the relationship between CLV and customer acquisition costs. This ensures that resources are channelled effectively, optimising profitability.

- Post-sale efficiency: A high CLV is not just an indicator of a stellar product but also points towards an efficient post-sale experience that keeps customers returning.

- Messaging clarity: When your CLV is high, it's a nod to the transparency in communication about your product's value. It ensures customers feel they're receiving value for their money.

- Marketing gap indicator: A scenario where you have a high CLV but a low conversion rate is a red flag. It suggests a potential disconnect in marketing messaging, signalling a need to reevaluate and refine the product's narrative.

- Customer-centric branding: Brands prioritising genuine connections and putting humans first are in the spotlight. A robust CLV is indicative of a brand that cherishes relationships and community above all.

- Investment insights: By juxtaposing CLV with other metrics like CAC, ROAS, and AOV, businesses can glean invaluable insights. These insights can guide investments in pivotal areas such as client retention, email marketing, and retargeting strategies.

- Accurate customer segmentation: When you pair CLV with demographic data, the result is enhanced customer segmentation. This precision in segmentation ensures better resource allocation and timely communications, ultimately bolstering customer loyalty and amplifying their overall value.

How Blend Commerce Helps You Focus On CLV

From all that we have discussed, it is clear that focusing on CLV is more critical than ever. Blend Commerce understands this and has positioned itself as a leading partner for eCommerce businesses looking to optimise their CLV. Here's how they do it:

- Emphasising CLV's Significance: Blend Commerce underscores the need to retain customers and ensure repeat purchases, especially in an era of rising traffic costs and heightened customer expectations.

- Customer Value Optimisation (CVO): Blend Commerce’s CVO service comprehensively analyses your current metrics, culminating in a detailed 12-month plan. The objective is to refine the entire customer experience, from initial site visits to post-purchase interactions.

- Data-Driven Strategies: By analysing key metrics such as Traffic, Conversion Rate, CAC, Margin, and Retention and employing RFM Analysis, Blend Commerce crafts strategies rooted in tangible insights.

- Redefining the Customer Journey: Through As-Is and To-Be Customer Journey Mapping, Blend Commerce aims to create a seamless and engaging experience, directly influencing CLV.

- Customised Solutions: Blend Commerce's offerings, from custom development to Klaviyo email management and tools like Gorgias, are tailored to address unique business needs.

- Tangible Outcomes: Partnering with Blend Commerce yields impressive results, including a 70% average increase in revenue and significant boosts in Average Order Value and Returning Customer Rate over a year.

The modern consumer is discerning and informed and seeks meaningful connections with their patronage brands. By embracing CLV with the help of Blend Commerce, businesses can align themselves with this ethos, fostering trust, loyalty, and a sense of community among their customer base.

Transform your brand's journey with Blend Commerce and tap into the true potential of Customer Lifetime Value!